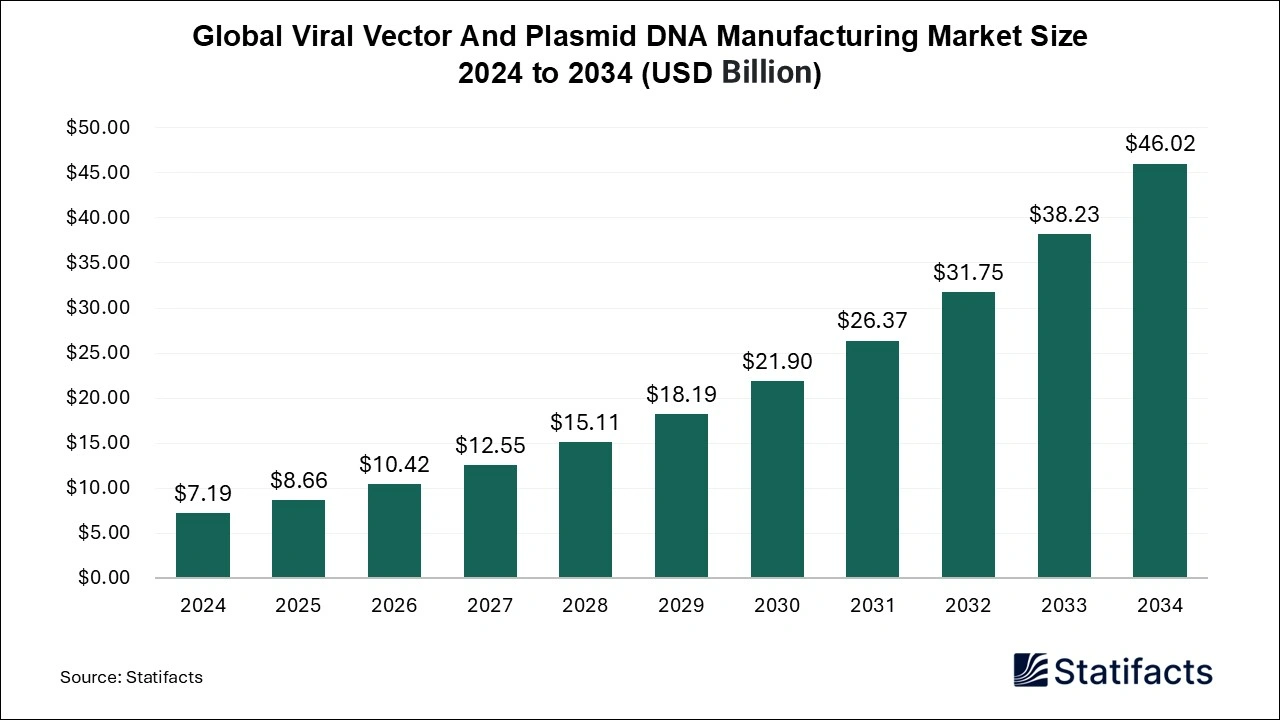

Ottawa, Feb. 19, 2025 (GLOBE NEWSWIRE) -- The global viral vector and plasmid DNA manufacturing market size was valued at USD 7.19 billion in 2024 and is expected to be worth around USD 46.02 billion by 2034, with a CAGR of 20.4% between 2025 and 2034, a study published by Statifacts a sister firm of Precedence Statistics.

The viral vector and plasmid DNA manufacturing market is expanding due to various rasons including advancement in gene therapy, increasing chronic diseases which majorly driven by high quality viral vectors and plasmid DNA, propelling the markets growth.

The viral vector and plasmid DNA manufacturing market is expanding significantly due to ongoing innovation in recent years. Advanced gene therapy and vaccine development have seen a sudden surge in recent years due to various diseases and their unidentified behavior with the human body's increased mortality rate, encouraging researchers to adopt vaccine development as prevention. Along with this, major leading players and manufacturers are investing and collaborating to continuously explore efficient ways to develop viral vectors and plasmid DNA.

Transient transfection technology is the primary innovative method used for large-scale production of viral vectors. Another method used is suspension cell culture systems for viral vector production. Until now, viral vectors and plasmid DNA have retained their position as critical elements of several gene therapy treatments, and no other alternative in the market can beat their efficacy.

Elevate your business strategy with market-driven insights—purchase the report today (Price USD1550) https://www.statifacts.com/order-report/7962

Viral Vectors & Plasmid DNA Manufacturing Market Key Takeaways

- North America has dominated the market with revenue share of 50.11% in 2024.

- By Vector Type, the AAV segment shows a leading growth in the viral vectors & plasmid DNA manufacturing market, accounted 21% revenue share in 2024.

- By Workflow, the downstream processing segment shows a dominant position in the viral vectors & plasmid DNA manufacturing market, accounted 55% revenue share in 2023.

- By application, the vaccinology segment has accounted largest revenue share of around 22.45% in 2024.

- By Disease, the cancer segment dominated the market with 41% revenue share in 2024.

- By end use, the research institutes segment has captured revenue share of around 59.4% in 2024.

Elevate your business strategy with Statifacts. Improve efficiency and achieve better outcomes—schedule a consultation today! https://www.statifacts.com/schedule-meeting

Viral Vector And Plasmid DNA Manufacturing Market Report Scope

| Report Attribute | Details |

| Market size value in 2025 | USD 8.66 billion |

| Revenue forecast in 2034 | USD 46.02 billion |

| Growth rate | CAGR of 20.4% from 2025 to 2034 |

| Base year for estimation | 2024 |

| Historical data | 2019 – 2024 |

| Forecast period | 2025 – 2034 |

| Quantitative units | Revenue in USD million/billion and CAGR from 2025 to 2034 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | Vector type, workflow, application, end-use, disease, region |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Country scope | U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait |

| Key companies profiled | Merck KGaA, Lonza; FUJIFILM Diosynth Biotechnologies; Thermo Fisher Scientific; Cobra Biologics; Catalent Inc.; Wuxi Biologics; TakarBio Inc.; Waisman Biomanufacturing; Genezen laboratories; Batavia Biosciences; Miltenyi Biotec GmbH; SIRION Biotech GmbH; Virovek Incorporation; BioNTech IMFS GmbH; Audentes Therapeutics; BioMarin Pharmaceutical; RegenxBio, Inc. |

Major Trends in the Market

Collaborations and acquisitions - The collaboration between large pharma companies and biotechnology firms is increasingly trending in the market to strengthen their roots. Major companies are acquiring small vectors and plasmid DNA manufacturers to reach to their proprietary technologies and production capability fueling the viral vector and plasmid DNA manufacturing market further. Such collaboration provides sens e of hold over pricing and market share for large firms/established companies while it provides resources and infrastructure facilities for smaller firms, consolidating both on the global stage.

Stringent regulations for safety - Product development, manufacturing process and market dynamics are influenced by stringent regulations set for the viral vectors and plasmid DNA manufacturing market. This is essential to follow owing to the patients’ safety and to maintain product quality which ensures authenticity of the product and builds trust among consumers. By navigating these regulations, manufacturers need to bring effective and innovative gene therapies for patients dealing with various health problems.

Engagement by biopharmaceutical firms - the major producers and consumers in viral vectors and plasmid DNA manufacturing is depends on the particular applications and demand from the users. In some areas, academic and research institutes dominate the market while in others biopharma firms are leading in usage. Though, due to increasing focus on gene therapy development and demand for viral vectors and plasmid DNA, contract manufacturing organizations CMOs and biopharma firms will become significant users of the market.

Opportunities in the Market

Strategic Partnerships

The major opportunity that viral vector and plasmid DNA manufacturing market holds is strategic partnerships between leading players aiming to expand their production rate, increase technological strength and to accelerate the development of gene therapies world widely and to commercialize it on larger scale. To meet the increasing demand from the healthcare sector, collaborations aids in resources and infrastructure sharing fostering tech innovations and minimizing expenditure on an individual scale while increasing production capabilities as well.

- For instance, in June 2024 U.S. based preclinical and clinical contract research organization known as Charles River labs and Captain T cell from Germany collaboratively launched a plasmid DNA and retrovirus vector production program agreement aiming to establish a contract development and manufacturing (CDMO) capabilities.

Regions Insights

Research & Product Development: North America to Sustain the Dominance

By region, North America accounted for the largest market share in 2024. The growth of this region is due to significant engagement of companies in research and development for gene and cell therapy along with increasing number of contract development organizations in the region. Moreover, companies started on a small scale looking for various ways to expand their manufacturing facilities to strengthen their root in the region. This is another critical factor helping the market to proceed further. Country wise, U.S. dominated the region while holding highest revenue share. This is achieved due to the presence of leading players in the region with ongoing activities like the launch of innovative products and methods along with CDMOs providing manufacturing services.

Booming Regulatory Landscape: Asian Countries to Grow Rapidly

By region, Asia Pacific is expected to witness the fastest growth rate in the market. On a national level, China is a major contributor to the expansion of the viral vector and plasmid DNA manufacturing market. This is due to continuous advancement in the regulatory framework for research activities on human genes and cells. Also, rising activities for developing and commercializing novel vaccines in China are key actors in market growth. The Chinese government's supportive initiatives for gene and cell therapy research further led to advancements in the biotechnology sector, creating a solid foundation for market expansion.

- For instance, In January 2022, WuXi Biologics partnered with Shanghai BravoBio Co, Ltd to augment the development of innovative vaccines to resolve growing challenges caused by infectious diseases.

Market Segmentation

By vector type

By vector type, the adeno-associated virus segment dominated the global market. In clinical trials AAVs witness huge demand and their utilization is frequent. This is due to the clinical trials made for development of orthopedic and ocular gene therapy exhibits increased efficiency and efficacy. According to the article from springer, AAVs helped gene therapy to prevent hearing loss. Applications of AAVs are increasing significantly across diverse industries, thus witnessing a robust growth rate.

By vector the lentivirus segment is expected to witness a fast growth rate. Growing use of lentiviral vectors in various research areas is key factor of the segments expansion, as the research industry is focusing on advancement with these vectors. For instance, In June 2022 a recent study stated that lentiviral vectors are majorly used to adopt vaccines which are particularly target dendritic cells and stimulate powerful T-cell immune response.

By workflow

By workflow, the downstream processing segment dominated the global market. The growth of this segment is due to highly complicated processes done for polishing and purification of clinical grad final products. Manufacturers are also actively involved in the novel economic downstream development process. The intent behind with this is to solve challenges related with traditional lab-scale manufacturing of vectors which further expand the market.

By workflow, the upstream processing segment is expected to witness a significant growth rate over the forecast period. It allows efficient cell culture processing with set up on automation mode for sampling which needs less labor, helps in lowering the cost of complete process.

By application

By application, the vaccinology segment dominated the global market. The growth of this segment is due to various infectious diseases and increasing demand for their solutions as a vaccination is primary reason. To develop such effective vaccines, viral vectors and plasmid DNA are significantly used. Moreover, the support by government funding for development of vaccines is key contributor of the market's growth.

By application, the cell therapy segment is expected to grow at the fastest rate in the market. The growth of this segment is due to the rising personalized treatment for fatal diseases like cancer with various types. Also, chimeric antigen receptor-based cell therapies are successful in cancer treatments, propelling the segments growth on a large scale.

By end use

By end use, the research institute segment accounted for the largest market share, thus dominating the global market. The growth of this segment is related to the research methods carried out to improve vector production by research entities is augmenting the segment. The researchers from the nanobiotechnology institute developed a highly advanced and shelf preserve formulation of ready-to-dose form of DNA molecules to create virus vectors. The growing number of collaborations between leading payers is also augmenting the market's growth on a huge scale.

By end use, the pharma and biotechnology companies' segments are expected to witness a fast growth rate over the forecast period. The growth of this segment is due to the launch of advanced therapies along with subsequent increase in the number of gene the reseacrh programs led by pharmaceutical companies.

By disease

By disease, the cancer segment dominated the global market in 2024. According to the stats, the rate of cancer is increasing, and it needs to be prevented at an early stage. Reasons behind this include the adoption of a Western lifestyle, over-alcohol consumption, chain-smoking, fast-food consumption, and a low nutritional diet, leading to exacerbating diseases into fatal conditions like cancer. Thus, increasing cancer cases directly impacted the growing demand for gene therapies to cure cancer, fueling this segment’s growth.

By disease, the genetic disorders segment is anticipated to witness a fast growth rate over the forecast period. Genetic disorders are the most targeted area of application for gene therapy. Many ongoing clinical trials are inclined towards the same. Hence, gene therapy for genetic disorders is the most critical market and is expected to support the growth of viral vectors and the plasmid DNA manufacturing market.

Competitive Landscape & Major Breakthroughs in the market.

The leading key players working in the market include Charles River Laboratories, Weisman Biomanufacturing, Genezen laboratories, Batavia Biosciences, Miltenyi Biotec GmbH, Wuxi Biologics, RegenxBio, Inc., Merck KGaA, Lonza, FUJIFILM Diosynth Biotechnologies, Thermo Fisher Scientific, Inc. Major companies are focusing on collaborations, partnerships, and expansions to compete in the global market.

You can place an order or ask any questions, please feel free to contact us at sales@statifacts.com

Recent Developments

- In February 2023, BioNtech SE confirmed that they have made the setup of first plasmide DNA manufacturing plant in the Germany. This initiative allows company to manufacture DNA independantly specifically curated for commercial and clinical applications.

- In October 2023, AGC Biologics made announcement that they will looking to expand their DNA manufacturing facility in Germany aiming to minimize the time required for manufacturing and to increase its production.

Viral Vector And Plasmid DNA Manufacturing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Statifacts has segmented the global Viral Vector And Plasmid DNA Manufacturing Market

By Vector Type

- Adenovirus

- Retrovirus

- Adeno-Associated Virus (AAV)

- Lentivirus

- Plasmids

- Others

By Workflow

- Upstream Manufacturing

- Vector Amplification & Expansion

- Vector Recovery/Harvesting

- Downstream Manufacturing

- Purification

- Fill Finish

By Application

- Antisense & RNAi Therapy

- Gene Therapy

- Cell Therapy

- Vaccinology

- Research Applications

By End-use

- Pharmaceutical and Biopharmaceutical Companies

- Research Institutes

By Disease

- Cancer

- Genetic Disorders

- Infectious Diseases

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Elevate your business strategy with market-driven insights—purchase the report today (Price USD1550) https://www.statifacts.com/order-report/7962

Browse More Research Reports ;

U.S. Cancer Monoclonal Antibodies Market ; The U.S. cancer monoclonal antibodies market size was estimated at USD 28,840 million in 2024 and is projected to be worth around USD 1,61,500 million by 2034, growing at a CAGR of 18.8% from 2025 to 2034.

U.S. Medical Disposables Market : The U.S. medical disposables market size accounted for USD 128.14 billion in 2024 and is predicted to touch around USD 487.69 billion by 2034, expanding at a CAGR of 14.3% from 2025 to 2034.

U.S. Healthcare Staffing Market ; The U.S. healthcare staffing market size is calculated at USD 19,490 million in 2024 and is predicted to attain around USD 33,860 million by 2034, expanding at a CAGR of 5.68% from 2025 to 2034.

U.S. eClinical Solutions Market : The U.S. eClinical solutions market size surpassed USD 3,840 million in 2024 and is predicted to reach around USD 13,010 million by 2034, registering a CAGR of 12.98% from 2025 to 2034.

U.S. CRISPR and Cas Genes Market : The U.S. CRISPR and Cas genes market size is calculated at USD 1,010 million in 2024 and is predicted to reach around USD 5,110 million by 2034, expanding at a CAGR of 17.6% from 2025 to 2034.

U.S. Disposable Endoscopes Market : The U.S. disposable endoscopes market size surpassed USD 24.68 million in 2024 and is predicted to reach around USD 115.63 million by 2034, registering a CAGR of 16.7% from 2025 to 2034.

U.S. Orthopedic Biomaterials Market : The U.S. orthopedic biomaterials market size accounted for USD 5,930 million in 2024 and is expected to exceed around USD 12,570 million by 2034, growing at a CAGR of 7.8% from 2025 to 2034.

U.S. mHealth Apps Market : The U.S. mHealth apps market size accounted for USD 12,550 million in 2024 and is expected to exceed around USD 53,020 million by 2034, growing at a CAGR of 15.5% from 2025 to 2034.

U.S. Anesthesia and Respiratory Devices Market : The U.S. anesthesia and respiratory devices market size is calculated at USD 8,620 million in 2024 and is predicted to reach around USD 17,440 million by 2034, expanding at a CAGR of 7.3% from 2025 to 2034.

You can place an order or ask any questions, please feel free to contact us at sales@statifacts.com

Statifacts offers subscription services for data and analytics insights. This page provides options to explore and purchase a subscription tailored to your needs, granting access to valuable statistical resources and tools. Access here - https://www.statifacts.com/get-a-subscription

About US

In a world drowning in data, where every decision feels like a gamble, there's a place where clarity reigns supreme. A place where insights are not just found but created. Welcome to Statifacts, where we transform raw numbers into actionable strategies, and where every piece of data offers a deep dive into industry’s insights.

We believe in data with a heartbeat. Numbers should be more than just figures on a screen; they should pulse with the life of your market, echoing the trends, the shifts, the opportunities that are just around the corner. Our statistics are curated, crafted, and delivered in a way that speaks directly to you, helping you make sense of the noise and find the signal that matters.

For Latest Update Follow Us:

Statifacts | Precedence Research| Towards Healthcare